News

Litigation finance as an investment tool is gaining popularity in Russia. There are funds, legal firms, and intermediary platforms in the market attracted by a rate of return as high as 150%. Law professionals are convinced that this segment will continue to expand as happened in the U.S. and UK. In these countries, dozens of market players have invested billions of dollars in litigation. Russia is five to ten years behind, and third-party litigation financing amounts to billions of rubles.

The litigation financing industry – a new investment tool - has emerged in Russia and is expanding. It is a practice in which a third-party investor covers expenses associated with preparation and filing of a lawsuit, as well as other legal expenses, in exchange for a share of the recovery awarded. Funding may be sought both by a plaintiff and a defendant (in exchange for a percentage of savings).

Litigation financing as an investment tool first appeared in 1990s in the United States. According to White & Case, in 2017, the volume of the industry exceeded USD 5 billion. The 2000s marked the period of rapid expansion, with growth reaching as high as 414% between 2013 and 2016. Major players are Juridica Investments and Burford Capital; among law firms, most the notable investors are Law Finance Group and Counsel Financial Services. The litigation finance segment is highly developed in the UK, too: as Pinsent Masons reports, its volume topped USD 1.97 billon. By 2009, the segment was growing by 743%. The largest player is the Association of Litigation Funders whose members are Burford Capital, Calunius Capital, and five additional firms.

It appears that litigation financing has been expanding all over the world, fueled, in particular, by a rising number of actions brought before international commercial arbitration costs (which are expensive) and high returns: on average, an investor may count on between 15 and 50% of the award. In Russia, however, this funding practice is relatively new. The first attempts to officially launch a litigation financing business were made in 2016 when Platforma and NFL Group were launched, followed by Sudinvest.ru and Sudfinance.

Who Is Investing?

Today the factors that may underlie the rapid growth of the litigation financing segment in Russia are, in addition to low competition, the relatively fast and cost-effective judicial process. However, even professional legal players have been cautious to date. One law firm only - Rustam Kurmaev & Partners - confirmed to Kommersant Daily that it positions itself as a litigation financier. A-Pro offers its clients access to litigation financing on its website; however, the firm’s staff described this service to us as on a case-by-case basis, saying that “in our practice, there were only two cases where litigation financing was needed, and none of these cases was this year.” Two more law firms advertising litigation financing services on their website did not provide any comments.

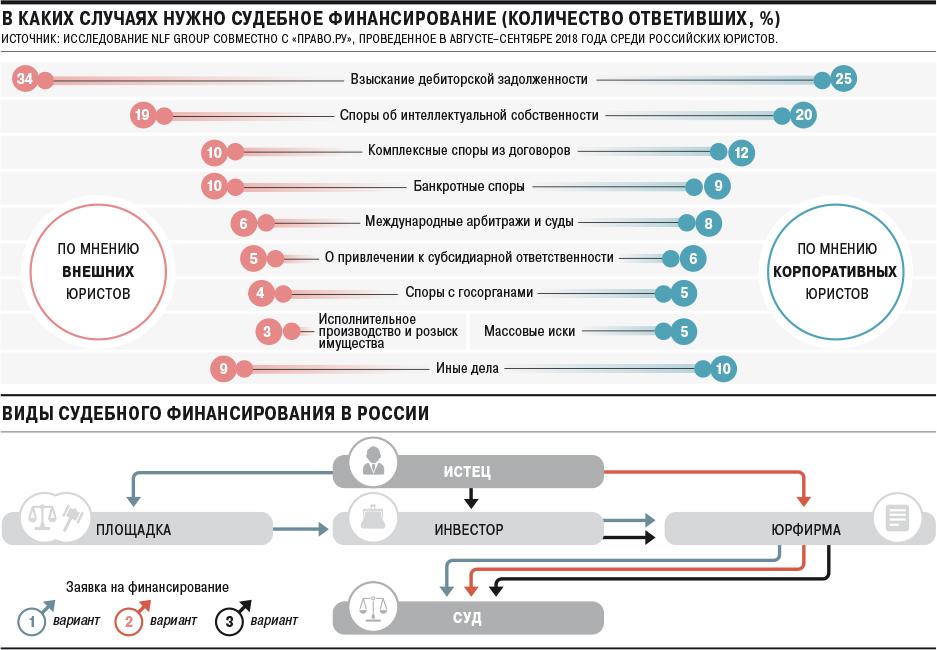

As a result, there are three types of litigation financiers: specialized platforms (such as Platforma or Sudinvest.ru), litigation finance companies (NLF Group or Sudfinance), and law firms (such as Rustam Kurmaev & Partners). For an applicant, on the one hand, it is easier to contact an investor or a law firm directly; on the other hand, they might not be interested. Online platforms do not provide funding themselves; rather, they match those seeking financial aid with prospective investors.

Terms of funding vary. Platforma, the most well-known funding service – charges a commission on the amount invested (10% on average) and a success fee (up to 10% of the recovery). Danila Korepanov, CEO of Sudinvest.ru, says that Sudinvest charges its fee from investor only; this fee is not capped and depends on the amount of funding, but may not be below 5%.

The investor covers the client’s legal costs in exchange for a share in the future recovery or purchases the claim at a discount and brings it to court itself. According to NLF Group, on average, they charge 20 to 40% of the recovery depending on the claim value, risk level, and other factors. Valeriya Pivovarova of Sudfinance did not disclose the investor’s share, pointing out that it depends on the award amount. Law firms providing litigation financing charge a success fee (i.e. percentage of the award) or purchase the client’s claim.

Investors are most often private persons. As Danila Korepanov says, they are usually businessmen, small or medium-sized entrepreneurs, or financial professionals aged between 25 and 50. “Third-party investors are interested in cases with low entity level and high return,” he adds. Some of the investors are legal professionals. “A lawyer is able to evaluate the chance of success, length of the process, and possible return,” points out Irina Tsvetkova, a lawyer who founded Platforma. Some players (Platforma and Sudinvest.ru) help plaintiffs find pro bono legal assistance.

What Claims are Financed?

The important factors in an investment decision are the plaintiff’s identity, the defendant’s ability to pay, and the predictability of legal costs. According to Irina Tsvetkova, litigation funding is sought by individuals, shareholders, business owners, owners of patents or copyright, or lawyers even who are looking for investors for their clients. Platforma deals with both corporate claims and large-scale or widely-publicized consumer disputes. One example is a class action lawsuit against the Moscow government objecting to renovation and air pollution. NLF Group focuses or large commercial disputes (average amount of funding of RUB 30 million) and consumer class action lawsuits. Rustam Kurmaev & Partners primarily handles disputes between companies. According to Sudinvest.ru, in their client base, the split between corporate and individual plaintiffs is 50/50. Sudfinance has so far been backing claims brought by individuals.

Over the almost two years of its existence, Platforma has received more than 500 applications for investment ranging from RUB 1 million to USD 10 million. “We have financed fifteen claims totaling RUB 1.5 billion; three cases have been adjudicated. Claims for RUB 500 million are still pending. Up to 2-3% of all applications are approved (in western countries – 1-2% of submitted claims),” says Irina Tsvetkova. According to Ms Tsvetkova, the average return for the platform is between 30% and 100% of the amount invested; financiers are mostly interested in arbitrazh cases with possible recovery over RUB 10 million.

Maxim Karpov, managing partner at NLF Group, reveals that the fund has financed “hundreds of cases”, most of them – small ones. There were four claims for amounts over RUB 100 million; the maximum budget per project topped RUB 60 million, including the purchase of claim. Sudinvest.ru reports approximately 300 applications received in one year and a half, eighteen of which were funded. Danila Korepanov points out that the average investment is RUB 250,000, with the average annual return for an investor of 150%. Roughly 50 cases are pending for over RUB 500 million. “An investor may be willing to back a claim as small as RUB 50,000; the most important thing is to correctly evaluate the defendant. What is the point of finding a funder if the defendant is not able to pay?” highlights Korepanov.

Valeriya Pivovarova of Sudfinance tells us that their project has been in place for only three months. Notably, the platform provides the financing itself. So far, they have backed three cases (with claims ranging from RUB 1.8 million to RUB 33 million); two of which are disputes between individuals, on one side, and banks or insurance companies, on the other side. Rustam Kurmaev says that, since 2010, his firm has financed ten projects with investments totaling USD 7 million; the firm’s return is not disclosed.

According to market players, a few billion rubles have been raised to finance litigation costs. Most backed cases are cases before Russian government arbitrazh courts; however, there are mentions of cross-border disputes. Thus, Platforma has helped fund disputes before international commercial arbitration courts, and the number of such cases is rising. Irina Tsvetkova is convinced that this type of dispute is most appealing for financiers. NLF and Sudinvest.ru also report applications submitted in relation to disputes in foreign jurisdictions, such as in Israel or EU.

Industry Outlook

According to the market survey conducted in 2018 by Platforma and NLF Group together with Pravo.ru, most lawyers are aware of litigation finance, but only 7-10% of respondents actually used it. Rustam Kurmaev believes that over the next five years the popularity of this funding tool will grow. “The Russian litigation finance industry has reached a level in its development seen in western countries 10-15 years ago. All factors are in place to spearhead its growth,” agrees Irina Tsvetkova.

Legal professionals welcome the advancement of litigation funding. Andrey Gorodisskiy, partner at Andrey Gorodisskiy & Partners, explains that litigation funding gives lawyers access to a wider pool of clients, enables investors to make a return, and helps clients get professional legal assistance. Yuliy Tai, managing partner at Bartolius, stresses the social impact of the litigation finance industry: it gives a client an opportunity to defend himself when his opponents are clearly much stronger. “Third-party financing improves the chances of enforcing the rule of law and getting justice which is very important for society and the government,” he says.

Still, lawyers are cautious about forecasting the future of the industry. Andrey Gorodisskiy believes that “the market will grow, but slowly.” Ilya Sorokin, associate at BGP, shares this view, saying “Investors needs guarantees of return and real hope that they will be able to earn as a result of the award enforcement. This is hardly possible unless we improve the general level of legal culture.” Sergey Pepelyaev, managing partner at Pepelyaev Group, points out that large investors still do not find this tool appealing. “The pros and cons of this service are apparent: we are talking about high return and high risk. The less resilient the national legal system, the higher the risk.” Yuliy Tai believes that the underdevelopment of the Russian legal market undermines the litigation finance segment, citing among negative aspects a lack of trust in the society: few institutions have undisputed good images and reputations, and there is a lack of strong regulation of specific legal relations; Tai adds that Russian courts do not favor success fees.

Is Litigation Financing Legal?

The Litigation finance industry does not require special regulation as the funding may be provided through claim assignment or as direct lending. In the UK, Australia, and South Africa, there are special laws on litigation funding, despite the fact that this tool is widely used and promoted. In the U.S., such laws are set out on the states level (in some states the practice of litigation funding is limited). Other countries, such as Ireland or India, prohibit litigation finding. Such a ban was also in place in Hong Kong and Singapore, but was removed. In Poland, Sweden, the Netherlands the situation is similar to Russia: litigation funding is not prohibited, but the segment is at an early stage of development.